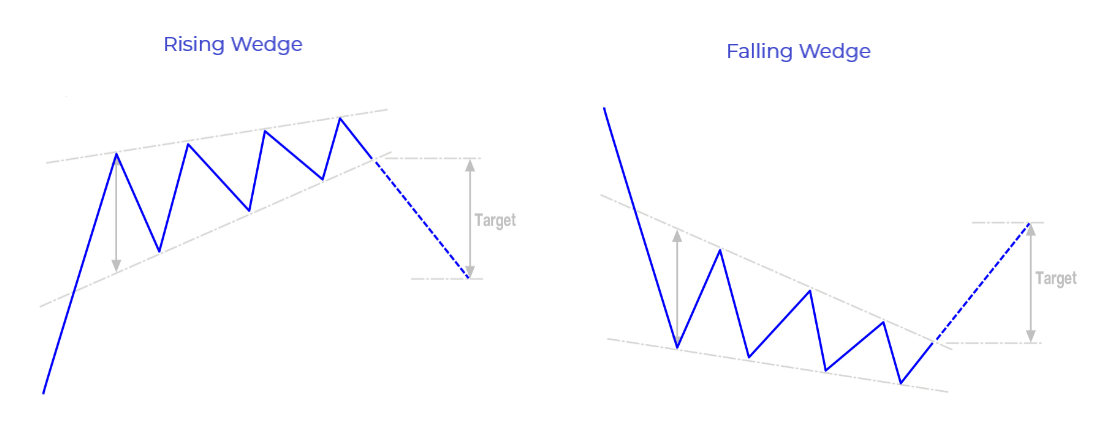

The same situation happens when using the falling wedge. In this case, the price will likely have a bearish breakout. This is where the two lines attempt to meet. When you spot a rising wedge, you simply wait until it nears its confluence level. The main method to trade the rising wedge pattern is to known as reversal. How traders can use the rising wedge pattern A rising wedge is usually a bearish indicator. And as they do this, the price forms what usually appears to be an ascending triangle pattern. It then finds some resistance as bears start to take profits. It forms when the price of an asset is in a sharp decline. How a rising wedge pattern happensĪ rising wedge, on the other hand, is the exact opposite of the falling wedge pattern. Therefore, while the wedge is still being formed, there is a possibility that the Beyond Meat price will continue rising as bulls target the previous high of $167. Interestingly, the bottom of the wedge happened at the 38.2% Fibonacci retracement level at around $120. Since then, the stock has been forming a falling wedge pattern. It then stared a bull run but it found significant resistance at $167 on June 17.

The chart below shows the stock price of Beyond Meat, a popular company that is disrupting the meat industry.Īs you can see, the price of the stock bottomed at $47.97 on March 19. As it reaches its tip, the price then breaks out higher and continues with the upward trend. All this creates a pattern that looks like a descending triangle pattern. As a result, some starts to sell and take profits, which pushes the price lower.Īs the price drops, some bulls start coming in but then exit after a while.

First, the price of an asset needs to be in a strong upward trend.Īs the price rises, it reaches a point where bulls start raising doubts about how high it can go. In the same way, a rising wedge usually leads to a bearish breakout How a falling wedge happensĪ falling wedge happens when several things happen. For starters, divergence happens when an asset’s price is rising while oscillators like the Relative Strength Index (RSI) and the MACD are falling.Ī bullish divergence pattern, on the other hand, happens when an asset’s price is falling while oscillators are falling. Wedges are closely related with divergences.

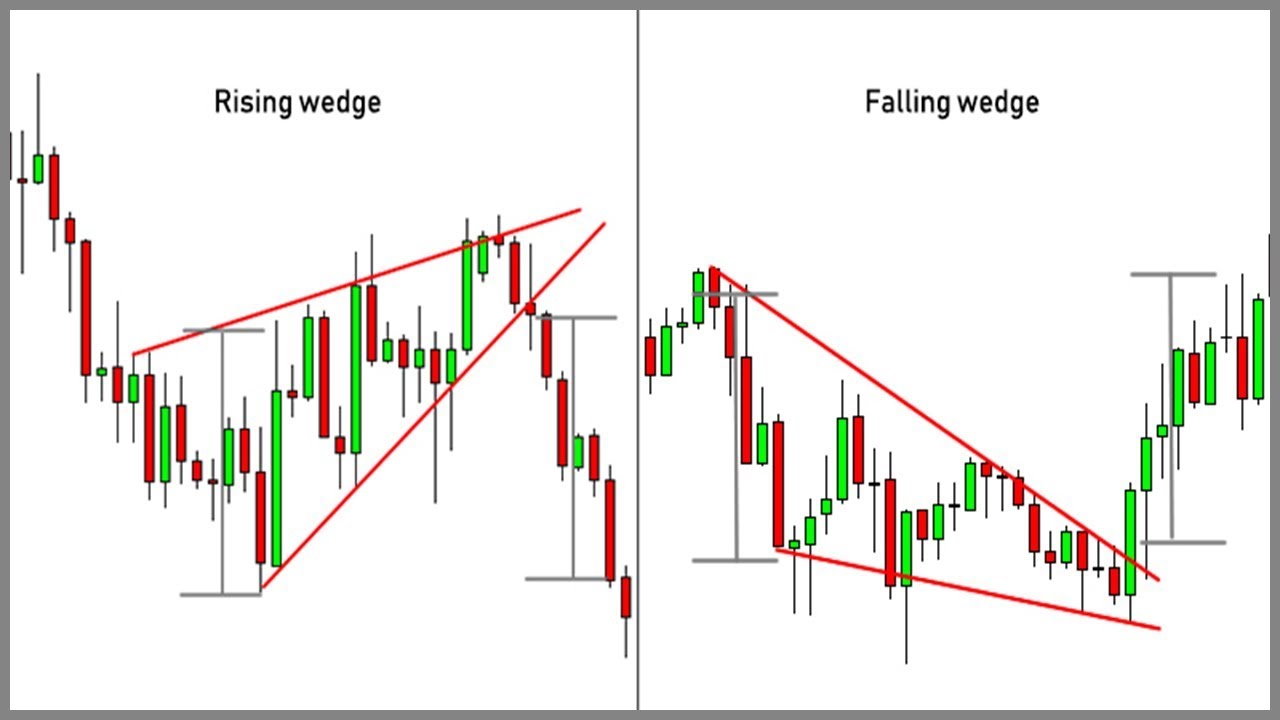

Related » Triangle Pattern in Day Trading Wedge patterns and divergences The chart below shows how a falling wedge looks like. The two wedges are usually seen as bullish and bearish, respectively. There are two types of wedge patterns, which include falling and rising wedge.Ī falling wedge is simply defined as a continuation pattern that is formed when a price fluctuates between two downward sloping and converging trendlines.Ī rising wedge, on the other hand, is a bullish chart that happens when the fluctuates between two upward sloping and converging trend lines. Unlike other candlestick patterns, the wedge forms within a longer period of time, between hours and days. What is a wedge pattern? Falling & Rising WedgeĪ wedge pattern is a triangular continuation pattern that forms in all assets such as currencies, commodities, and stocks. How traders can use the rising wedge pattern.What is a wedge pattern? Falling & Rising Wedge.

0 kommentar(er)

0 kommentar(er)